Mortgage rates are not expected to fall further this year, but rising wages are likely to improve affordability for buyers.

Mortgage rates are expected to remain around 4% or slightly higher for the remainder of the year. This forecast comes amid a backdrop of cautious optimism in the housing market, where factors such as rising wages and steady house prices are influencing affordability.

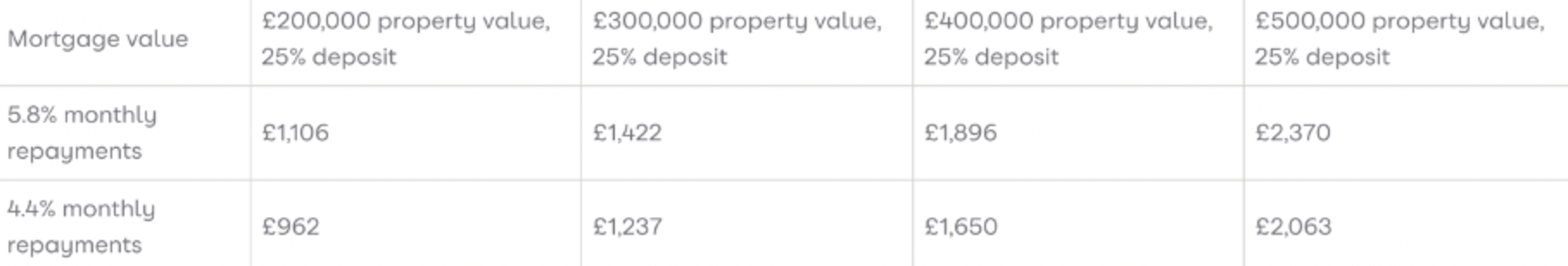

In June last year, the average five-year fixed-rate loan for a 75% loan-to-value mortgage peaked at 5.8%, adding hundreds of pounds to monthly mortgage repayments for buyers and homeowners.

Today, that same mortgage has now fallen to an average rate of 4.4%.

Here’s how that difference pans out in terms of monthly mortgage payments.

Monthly repayments on a five-year fixed-rate 75% LTV over 25 years

Stable Mortgage Rates: Mortgage rates are forecasted to hover around 4% or slightly higher throughout 2024. Despite potential fluctuations driven by factors like inflation and the Base Rate, any declines are expected to be modest. This stability in mortgage rates reflects the current market sentiment and the pricing already factored into fixed-rate mortgages.

How buyer affordability could improve in 2024: One of the key drivers for improved affordability in 2024 is the anticipated rise in household disposable incomes. Projections suggest a 3.5% increase in disposable incomes over the year, significantly impact buyers' purchasing power. Additionally, the expectation of flat house prices further contributes to enhanced affordability, making homeownership more attainable for aspiring buyers.

More choice for buyers in 2024; A notable trend in 2024 is the greater availability of homes for sale compared to previous years. With approximately 20% more homes on the market, buyers have a wider selection to choose from. This abundance of choice not only empowers buyers but also provides them with more negotiating leverage when considering their options.

Popularity of Affordable Regions: Affordable regions, particularly those with more accessible house prices such as Yorkshire and the Humber and the North West, are witnessing robust growth in sales activity. Buyers are gravitating towards these areas where affordability aligns with their financial capabilities, driving demand and market momentum.

Steady House Prices: Amidst the backdrop of increased housing market activity and buyer interest, house prices are expected to remain steady in 2024. Sellers are offering smaller discounts compared to previous periods, signalling a stabilisation in pricing trends. While negotiations are still possible, the diminishing discounts suggest a market that is balancing out.

While mortgage rates are unlikely to experience significant declines in 2024, the housing market is characterised by improving affordability driven by rising incomes and steady house prices. With a greater selection of homes available and favourable conditions in affordable regions, buyers have opportunities to find suitable properties. This combination of factors paints a picture of optimism and stability in the housing market for the remainder of the year, talk further about mortgages click here.

Sourced from Zoopla

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link